Wills and Trusts: Which One Do I Need?

According to the US National Center for Health Statistics, life expectancy for adults in this country is 77 years old. The good news is that these senior citizens have the time they need to create estate plans that secure their future and those of the people they love.

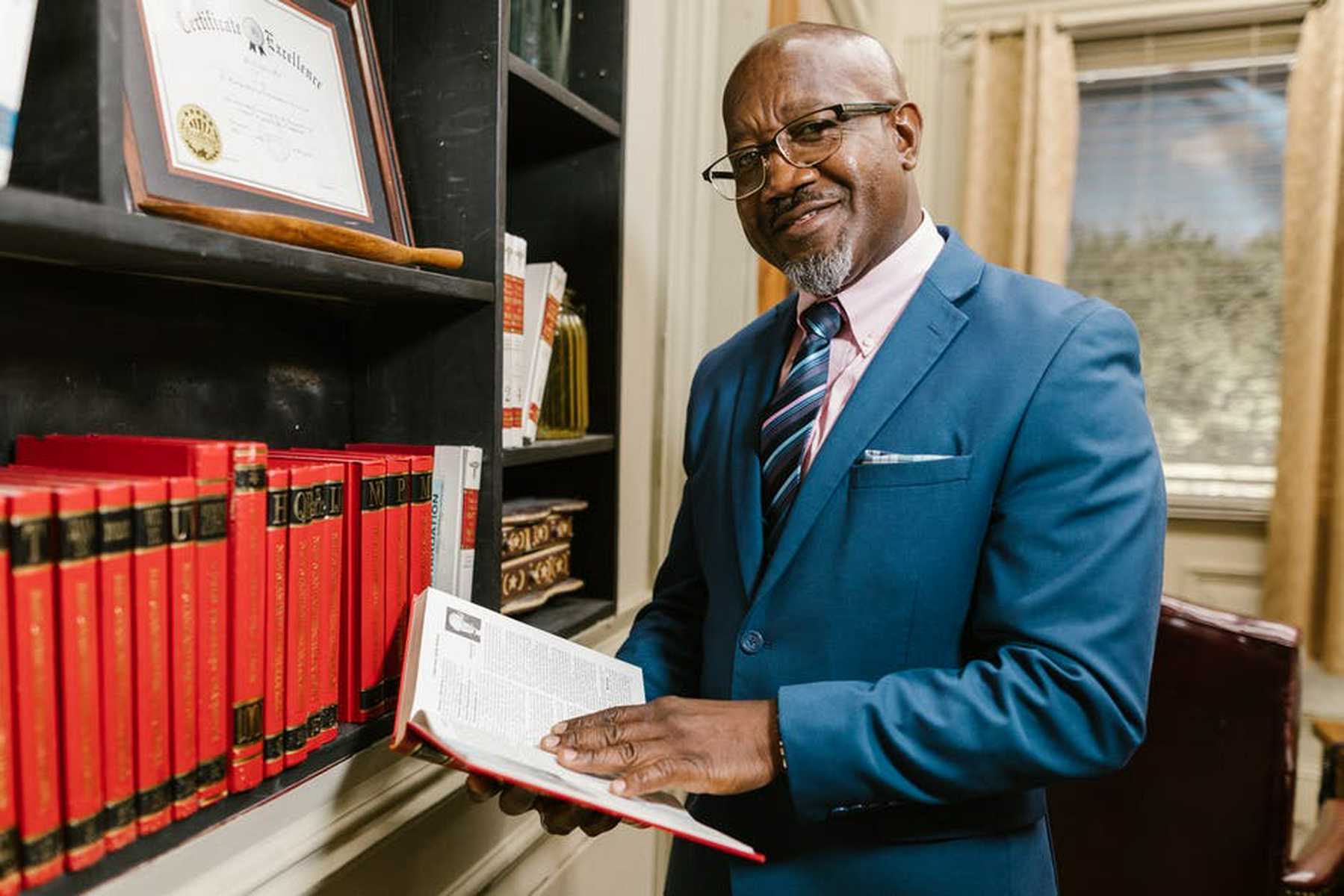

Two of these popular tools are wills and living trusts. Find out more from this elder law attorney in Melbourne FL on the differences between a will vs trust. Study these features and you’ll know which estate planning tool is best for you.

What is a Will?

Wills are written documentation that outlines how you want to distribute your assets after you die. Wills can be revised, as well as canceled, whenever you want throughout your lifetime. A will also appoints guardians for your children in case you die prematurely.

What is a Trust?

Trusts, or “living” trusts can help manage your assets both after and before your death. Living trusts help you identify where your property goes and when your beneficiaries will inherit it. Living trusts can also help you manage your assets in case you become disabled and can’t manage them on your own.

A living trust is classified as either irrevocable or revocable. An irrevocable trust means that it can’t be revised after it has been finalized. Revocable trusts let you change your wishes and terms whenever you want throughout your life.

What’s the Difference Between Wills and Trusts?

Both wills and trusts can outline your wishes to distribute your assets after your death. Consider the differences outlined below so that you’ll know if one is a better tool for you.

Public Access to Estate Information

Information contained within a living trust is confidential information. Only the estate administrator or a beneficiary who has access to the trust file will be able to review it.

Wills filed with the Register of Wills can be searched by the public. The general public can conduct an estate search either by mail or by visiting the courthouse in person.

Probate Court Proceedings

Wills are subject to probate litigation. Probate is the department within the court system that makes sure someone’s assets are allocated to the right beneficiaries after they die. The court also ensures that the deceased’s debts are paid in full.

Will vs. Trust: Which Should I Choose?

Still trying to decide if a will or trust is your best option? Check out these other factors to consider.

Current Age/Health

A living trust isn’t required if you are middle-aged and enjoying good health. A living trust will suit you better if you know you have an impending illness that will reduce your ability to manage your assets.

Current Obligations or Time Restraints

Administering your trust will place significant demands on your time. You’ll have to constantly identify legal ownership changes for any assets included in your trust. This includes bank accounts, vehicles, or business enterprises named in the trust.

Family Situation

If you’re married, a will conveys your property to your spouse. If you and your spouse die prematurely, wills can identify a guardian for any young children you leave behind.

Contact an Elder Law Attorney in Melbourne FL to Assist

Don’t leave estate planning to luck! Contact this elder law attorney in Melbourne FL to plan ahead and navigate the complex world of wills and trusts.

Both tools are designed to disperse your property as you see fit. Let me use my professional credentials to help you decide which one will serve you best.

You might also like