January 20, 2026

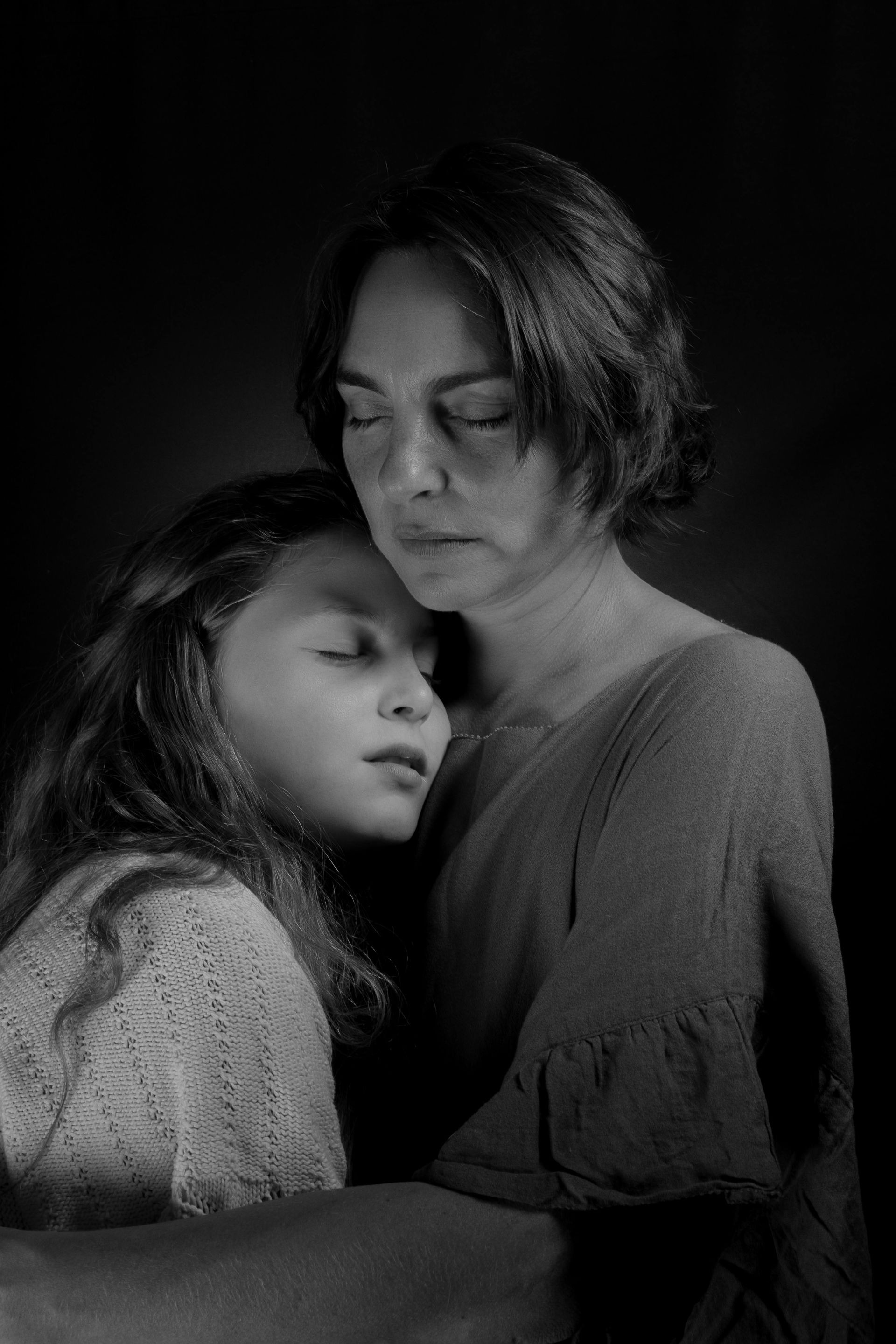

Guardianship planning is one of those topics many people know they should address—but often put off because it feels heavy, legal, or emotionally charged. Whether you’re thinking about your children, an aging parent, a loved one with disabilities, or even your future self, starting early is an act of care and responsibility. The good news? You don’t have to do everything at once. Here’s a clear, approachable way to begin. What Is Guardianship Planning, Really? At its core, guardianship planning is about deciding who would make decisions if someone cannot make them for themselves . This might involve: Minor children , if parents are unable to care for them Adults with disabilities or special needs Older adults who may lose capacity over time Your own future , in case of illness or incapacity A guardian may be responsible for personal decisions (healthcare, education, living arrangements), financial decisions , or both. Because guardianship often involves court oversight and limits legal rights (especially for adults), thoughtful planning is essential. Clarify the Situation Start by answering a few basic questions: Who might need a guardian? Is this planning for the future, or is there an immediate concern? What kinds of decisions would need support—personal, financial, or both? Being clear about the why helps guide every other decision. Know the Alternatives Guardianship is not always the first or best solution—especially for adults. Depending on the situation, less restrictive options may work just as well, including: Financial power of attorney Healthcare proxy or medical power of attorney Supported decision-making agreements Trusts (particularly special needs trusts) Representative payees for government benefits Exploring these options early can preserve independence while still providing protection. Choose Potential Guardians Carefully This is often the hardest—and most important—part. When considering someone, think about: Their values and judgment Emotional and financial stability Willingness and ability to take on the role Relationship with the person needing care Location and availability Always have an open conversation before naming someone. And don’t forget to name backup guardians . Put Your Wishes in Writing Good intentions aren’t enough—your wishes need to be documented. Depending on your situation, this may include: A will naming guardians for minor children Standby guardianship forms Powers of attorney and healthcare directives A letter of intent (not legally binding, but incredibly valuable) A letter of intent can explain daily routines, medical needs, education preferences, values, and personal wishes—things no legal form ever captures well. Work with the Right Professional Guardianship laws vary widely by location, so professional guidance matters. Look for: Estate planning attorneys Elder law attorneys Special needs planning attorneys (if applicable) They can help ensure your plan is legally valid, up to date, and tailored to your situation. Review and Update Regularly Life changes—and your plan should too. Revisit guardianship decisions: Every few years After major life events (births, deaths, moves, divorce) If a guardian’s circumstances change A plan that once made perfect sense may not always be the best fit. Final Thoughts Guardianship planning isn’t about predicting the worst—it’s about protecting the people you care about and giving yourself peace of mind. Starting small, asking the right questions, and documenting your wishes can make all the difference when it matters most. If you take only one step today, let it be this: start the conversation . Call Rhodes Law, P.A. today at 321-610-4542 ! The rest can follow, one thoughtful decision at a time.